Open enrollment for 2020 health insurance will be here before we know it. And the 2020 presidential election won’t be far behind. Some may wait to see how the results impact healthcare policy, opting out of ACA plans and instead choosing alternative coverage such as short term health insurance for the year to come.

It’s already happening. ACA enrollment numbers have shifted since the 2016 election. The tax penalty for going without minimum essential coverage has been lifted, and trends indicate that consumers are looking for affordable options through and beyond the health insurance marketplace (i.e., exchanges) created under the Affordable Care Act.

The Centers for Medicare & Medicaid Services recently reported that about 2.5 million people had left the health insurance exchanges between 2016 and 2018. Who are they? The people who don’t qualify for subsidies to help with health insurance premiums and out-of-pocket costs. The Census Bureau has also reported that the number of uninsured people rose by 1.9 million in 2018, mostly among Hispanics and foreign-born individuals.

Meanwhile, in several rural states that have struggled with a lack of health insurance options, enrollment increased among people with household incomes below 400% of the federal poverty level—the population that qualifies for subsidies. As the farming crisis continues to impact households in states such as these, will people who don’t qualify for subsidies look for ways to minimize healthcare expenses?

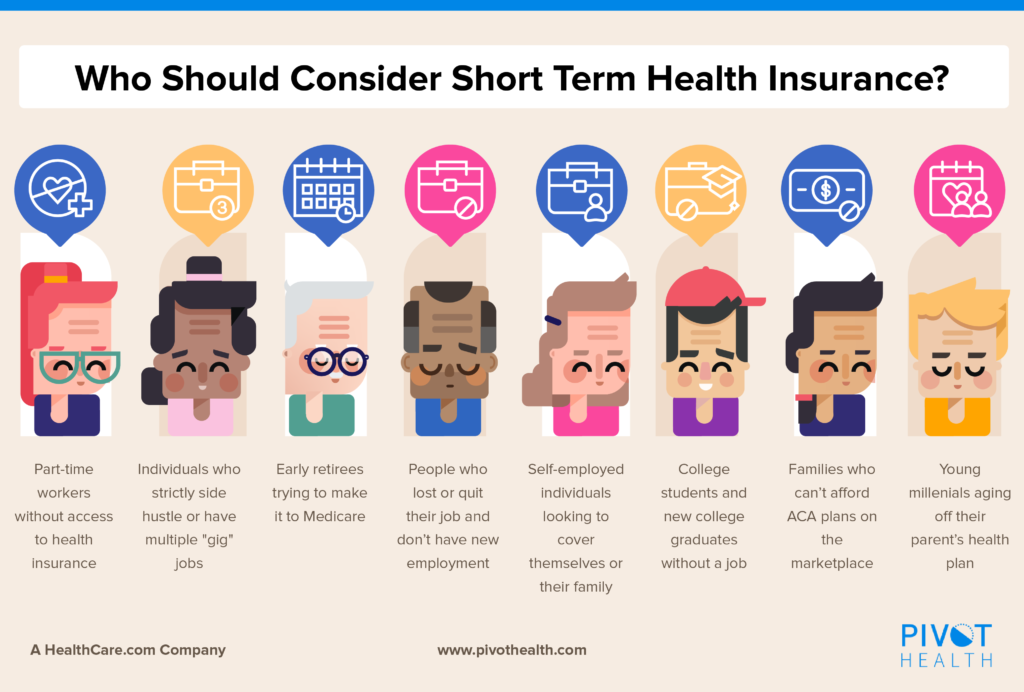

Numerous factors that impact health insurance enrollment will continue to evolve and influence enrollment decisions. Consumers looking for major medical insurance that includes all benefits required by the ACA and those who qualify for subsidies will want to select ACA plans. Those who aren’t subsidy-eligible and don’t need all of the ACA-mandated benefits may consider a short term health plan.

Is a short term plan right for you in 2020?

If you aren’t eligible for the subsidies that help make ACA plans affordable and aren’t sure what to do, short term health insurance could be a budget-friendly option.

Why are short term medical insurance rates so much lower? Short term medical plans, also known as temporary health insurance, don’t offer the same amount of coverage as ACA plans. Nor do they satisfy the law’s minimum essential coverage requirements, meaning they are not guaranteed issue and you most likely won’t have access to all of the essential health benefits (e.g., pregnancy and childbirth) or preventive care (e.g., birth control, immunizations) that major medical plans must include.

You can find a variety of short term health insurance plans on the market today. Some even include extras such as telehealth, prescription drug discounts, and vision discounts. You can customize your coverage by choosing things like:

- Policy length. Get coverage for 30 to 364 days, depending on your state’s laws.

- Deductible. Different options help you achieve a premium and out-of-pocket obligation you find affordable.

- Providers. Most short term plans are network-free, which means you can receive care from the doctors and hospitals you prefer.

Also, there’s no rush to decide. Short term policies are readily available year-round. You can apply online anytime. If you’re approved and you decide to enroll, your policy can begin as soon as the next day.

Short term health insurance, in summary

Short term health insurance is designed to be a temporary solution for individuals and families who struggle to afford Obamacare but want coverage in the event of an unexpected illness or injury. The premium may be appealing, but this option won’t be a good fit for everyone.

A short term plan may be right for you if you:

- Don’t qualify for an ACA subsidy and need affordable benefits for unexpected medical care.

- Qualify for a short term policy based on health history and don’t have a pre-existing condition or ongoing healthcare needs.

- Understand that benefits will be more limited than what the ACA requires of major medical insurance.

- Want a temporary solution between Obamacare plans.

This option may not be right for you if:

- You qualify for an ACA subsidy that allows affordable access to minimum essential coverage.

- Need guaranteed issue coverage.

- Have pre-existing conditions or ongoing healthcare needs.

- You require the full range of essential health benefits and preventive care services that all major medical plans must include.

Short term health insurance availability and duration limits vary by state. You can get an online quote to find plan options and rates where you live. If short term coverage isn’t right for you, then you’ll want to enroll in an ACA plan.

Is ACA health insurance right for you in 2020?

Major medical insurance is the coverage people often refer to as Obamacare or an ACA plan. When you enroll in one of these plans (either on or off the state and federal health insurance exchanges), you’re getting a health insurance policy that meets all ACA requirements and is considered minimum essential coverage.

That means the policy:

- Is guaranteed issue — You can’t be denied coverage or charged more based on your health history.

- Includes all essential health benefits — These categories include doctors’ services, inpatient and outpatient hospital care, prescription drug coverage, pregnancy and childbirth, mental health services, emergency services and more.

- Provides no-cost preventive health services — The ACA requires certain preventive care be provided at no additional cost beyond you premium, as long as you visit a network provider. These services may include things like shots and screening tests.

- Will be eligible for income-based subsidies — You may qualify for premium tax credits and cost-sharing reductions when you enroll in an ACA plan through one of the exchanges.

You can see that while pre-subsidy ACA plan premiums may be higher than short term plan premiums, the coverage requirements for ACA plans are greater. Beyond the basic requirements, some policies may include some additional benefits at their discretion. Otherwise, key differentiators between plans include provider networks, premium rates, and cost-sharing requirements (e.g., deductible, coinsurance).

Obamacare, in summary

ACA plans are designed to make healthcare accessible and affordable to as many people as possible. They include benefits that range from wellness checkups to hospitalization. For those who need access to the most coverage and qualify for subsidies that make it affordable, this is probably the best option. For others, it may seem financially out of reach.

An ACA plan may be right for you if you:

- Qualify for subsidies that help lower your plan premium and out-of-pocket costs.

- Need guaranteed issue coverage.

- Have pre-existing conditions or ongoing healthcare needs.

- You require the full range of essential health benefits and preventive care services that all major medical plans must include.

You may want to consider another option such as short term health insurance if you:

- Don’t qualify for an ACA subsidy and need affordable benefits for unexpected medical care.

- Qualify for a short term policy based on health history and don’t have a pre-existing condition or ongoing healthcare needs.

- Understand that benefits will be more limited than what the ACA requires of major medical insurance.

- Want a temporary solution between Obamacare plans.

As mentioned above, you will need to enroll in Obamacare during the annual open enrollment period or qualify for special enrollment to buy it another time of year.

How ACA open enrollment works

Open enrollment can feel confusing to many of us. Whether you are purchasing an individual health insurance plan for the first time or have purchased one several times, it can feel like a lot to sort through and understand.

Here’s a refresher on what to expect and how you might approach the process:

Enrollment begins (November 1 in most states) both on and away from the state-based and federal health insurance exchanges (i.e., marketplaces).

At this point, you can see what plans are available to you. Even if you don’t intend on enrolling right away, it may be worthwhile to look at your 2020 options and consider your needs earlier rather than later.

Estimate your subsidy using online tools (through a government exchange as well as other websites) to see if you might be eligible for income-based premium tax credits or cost-sharing reductions.

You’ll need to enroll in coverage and apply for subsidies through a state-based or federal health insurance exchange to receive a final decision and subsidy amount.

No subsidy? If an ACA plan is unaffordable to you and you don’t need all of the benefits offered by one, you may want to consider a short term health insurance plan. You’ll need to apply to see if you qualify.

Begin shopping. You could start with this, too, but knowing your potential subsidy eligibility may help you narrow down where to look for coverage. If you are eligible for a subsidy, you’ll want to enroll through a government exchange. If not, you may want to explore your options in the private market.

Narrow your plan options. As a starting point, you may want to consider what metal level will best suit your healthcare needs and budget. Generally speaking, you can expect the lowest premiums and highest cost-sharing with a bronze plan. As you move through the metal levels you’ll start to spend more in premium and have less cost-sharing. If you qualify for a cost-sharing reduction, you’ll need to look into the silver plans available to you the exchange.

Compare a few plans that seem like a good fit. In addition to premium, look at details such as deductible, coinsurance, out-of-pocket maximums, networks (e.g., are your preferred providers in-network?).

Choose a plan and enroll. Once you’ve decided on a plan, you’ll need to fill out an application to enroll. ACA plans are guaranteed issue, so the application will automatically be approved.

Short term health insurance, which is only available in the private market, is not guaranteed issue. If you decide to go this route, then you’ll need to fill out an application and answer a few health questions that will determine your eligibility. You’ll receive a decision within moments and can enroll if your application is approved.

Begin coverage with the new year. Your 2020 ACA policy will take effect on January 1, 2020.

If you enroll in a short term policy, you can begin coverage as soon as the next day—even if it’s still 2019.

Help is always available. You can find resources, including local assistance, through an exchange or an insurer’s website. Licensed health insurance agents can also answer your questions and guide you through the process.

State health insurance exchanges

Most states use the federal exchange, but there are several that currently operate their own exchanges. Others are either considering or transitioning to a state-based exchange in the near future.

The 12 state-based exchanges prior to 2020 open enrollment included:

- California

- Colorado

- Connecticut

- District of Columbia

- Idaho

- Maryland

- Massachusetts

- Minnesota

- New York

- Rhode Island

- Vermont

- Washington

A 13th state-based exchange debuts for 2020 open enrollment: Nevada. The state will move away from the federal platform, and enrollees will use Nevada Health Link instead.

States that are considering or will soon be launching their own exchanges include:

- Maine (under consideration)

- New Jersey (transitioning)

- New Mexico (transitioning)

- Oregon (under consideration)

- Pennsylvania (transitioning)

2020 ACA open enrollment dates

For all states that use HealthCare.gov and some others, 2020 open enrollment will run from Fri. Nov. 1, 2019, through Sun., Dec. 15, 2019. Your 2020 policy will then become effective on January 1.

However, open enrollment dates vary slightly for a few of the state-based exchanges.

- California: October 15 through January 15

- Colorado: November 1 through January 15

- District of Columbia: November 1 through January 21

- Massachusetts: November 1 to January 23

- Minnesota: November 1 through December 23

Check your state’s exchange to confirm 2020 open enrollment dates; others may announce adjustments in the weeks ahead.

Need coverage before 2020?

If you become uninsured in 2019 and need health insurance benefits until your 2020 policy begins, you have a couple of options.

To enroll in an ACA plan, you’ll need to become eligible for a special enrollment period due to a qualifying life event such as getting married, having a child, or moving to a new ZIP code. Your special enrollment period offers a window of time in which you can change or enroll in an individual health insurance plan outside of the annual open enrollment period.

If you don’t qualify for a special enrollment period, then you may want to consider short term health insurance until your 2020 ACA plan begins. Short term plans are available year-round to those who qualify. You can quickly get a quote and apply online anytime, day or night.

877-246-0106

877-246-0106