Thinking about health insurance but wondering if you need to sign up right away? Let’s dive into why getting health insurance quickly is a smart choice and who needs to think about getting covered without delay.

Whether you work for yourself, are between jobs, retired early, are healthy but without insurance, waiting for your next insurance to start, or are without insurance, it’s important to get health insurance.

We’ll talk about the perks of getting insured ASAP, how to find a policy fast, and what to think about before you make your choice.

Discover why choosing health insurance quickly is key for you and your loved ones. Secure the safety net you need.

Key Points to Consider:

- Don’t delay getting health insurance, especially during the Annual Open Enrollment Period; getting covered immediately is vital for both your wallet and your well-being.

- Whether you’re your self employed, in between gigs, just retired, or currently without coverage, you need to consider getting insured without delay.

- Instant health insurance means you’re prepared for the unexpected, can keep up with preventive health checks, and know you’re protected.

Why Jump on Health Insurance Now?

Immediate health insurance smooths the way to consultations with doctors and specialists, ensuring you get the care you need without holdups. In today’s fast-moving world, having that insurance safety net from the outset is crucial for everyone, both singles and families, to help them remain secure and well.

Who Needs Quick Health Insurance Coverage?

Getting health insurance on the spot is crucial for a range of folks, including freelancers, those in job transition, early retirees, those awaiting coverage, and the uninsured.

Freelancers often miss out on employer health benefits and face the challenge of finding affordable coverage on their own.

Job changers might experience a lapse in insurance, leaving them exposed to unexpected medical bills.

Early retirees need to bridge the gap to Medicare with their coverage, while the healthy often don’t realize the importance of insurance until it’s too late.

Those in waiting periods, like new employees or recent grads, and the uninsured are all in a tight spot without immediate coverage.

The Upside of Immediate Health Insurance

Instant health insurance has loads of benefits: it can help cover surprises, shields against steep health costs, provides access to preventive care, and gives policyholders an insurance policy they can add to their financial base.

By offering swift access to medical care, immediate health insurance ensures health issues are dealt with promptly, avoiding complications. It can help protect your finances from sudden medical expenses, keep your savings intact, encourage regular check-ups, help catch health issues early and support overall wellness.

So, whether you’re navigating life changes, valuing your health, or simply in need of coverage, the message is clear: don’t wait. Getting health insurance now is a smart, protective step for your future.

Affordable Care Act (ACA) Plans: Coverage for Unexpected Medical Expenses

Having health insurance right away is key for covering sudden medical costs. This protection means a lot when unexpected health emergencies pop up, giving people a safety net during tough times.

ACA health plans cover lots of medical needs like hospital stays, surgeries, medicine, and check-ups to keep you healthy. These plans take care of you, covering a bunch of health services and even pre-existing conditions, so you don’t have to worry about big healthcare bills. You just need to be mindful to sign up for a health plan during the Annual Open Enrollment Period, or the year if you have a life situation come up, like a job loss.

In addition, Medicaid.gov is super helpful for low-income families and individuals who meet financial requirements. It helps them get the medical care they need, like seeing a doctor, staying in the hospital, getting medicine, and regular check-ups.

Shielding From Big Health Costs

Immediate health insurance is like a shield against big health costs. It helps out by making sure you can get the medical care you need without the stress of big bills, thanks to things like ACA subsidies and emergency plans in all 50 states like Texas, Florida, New York, and California.

With this insurance, you won’t have to sweat over the cost of getting better. ACA subsidies help lower the cost of monthly health insurance costs, making it easier on your wallet. And in emergencies, having a plan means you can get help fast without worrying about the price tag.

Getting to Preventive Care

Immediate health insurance means you can get to important check-ups and screenings that help catch health problems early. With cool options like talking to doctors online, staying on top of your health is easier than ever.

Preventive care keeps you healthy by catching problems early with regular doctor visits and shots. Telemedicine lets you chat with doctors from home, making health advice easy to get. And with plans focused on preventive care, you’re encouraged to look after your health before problems start.

Peace of Mind

In uncertain times, having health insurance can mean you’re ready for anything, health-wise. ACA bronze or silver plans can be a budget-friendly way to make sure you’re covered. With the wide coverage options, you can feel good about your healthcare choices.

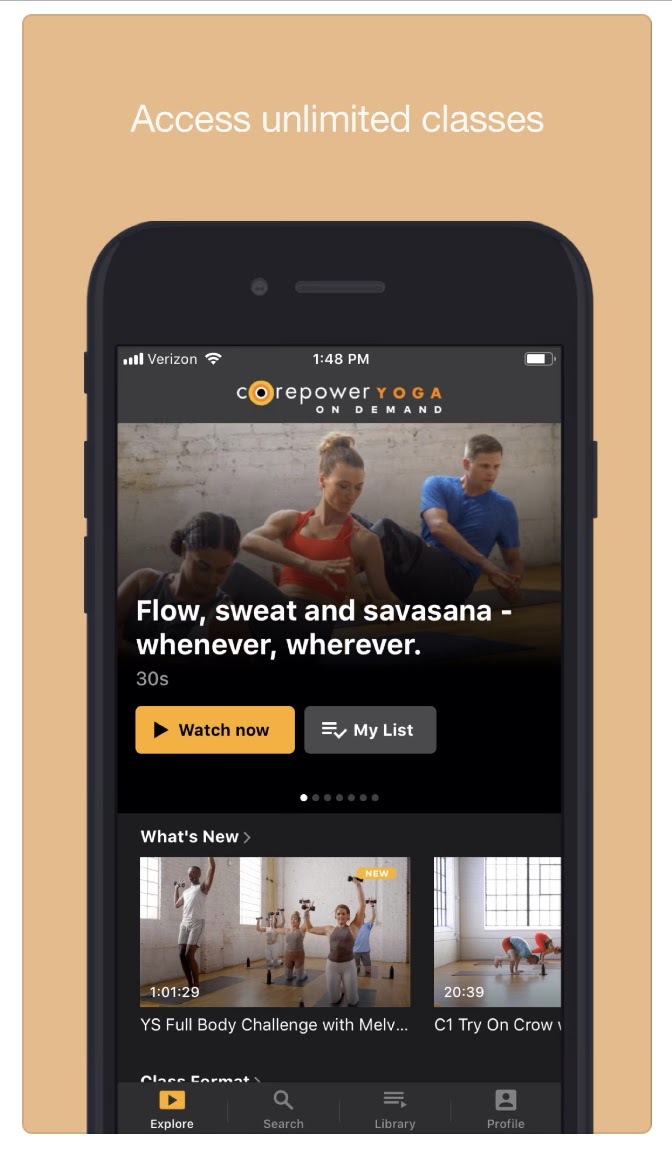

Need to Buy Health Insurance Immediately? Get Short-Term Medical

Want to get health insurance fast? Short-term medical insurance could be an option for you right now. You can enroll in a short-term medical plan at any time, and coverage begins the very next day. So, review your options, compare plans, figure out what you can spend, and then sign up for the insurance that works best for you and have coverage in less than 24 hours. Here’s a step-by-step guide to help you through it:

1. Look at Insurance Plan Differences

Looking at different options helps you find plans that fit what you need, like doctor office visits, emergency room care, hospital services, and whether a preventive health visit or immunizations are offered at least once a year. Checking out all the options helps you see which plan gives you the most for what you can spend.

It’s important to remember that short-term medical insurance plans are temporary coverage and not comprehensive health insurance. They have fewer benefits and are not required to meet federal protections of ACA plans sold on the Health Insurance Marketplace. Individuals with pre-existing conditions or those needing long-term care should look to ACA plans for major medical coverage.

2. Compare Plans

Once you’ve found a few options, compare them to see how they match up with what you need. Think about things like whether they help pay for Urgent Care or if they offer low-cost telemedicine to skip the waiting room.

3. Think About What You Can Spend and What You Need

Before you pick a plan, think about how much money you can spend and what kind of healthcare you need. Remember, short-term medical is temporary health insurance, so you only need to buy what you think you might need for the coming months, not long-term care.

Thinking about how much you can afford for insurance every month and what you usually spend on healthcare can help you pick a plan that doesn’t cost too much but still covers what you need.

4. Sign Up for the Plan You Choose

After picking a plan that fits your budget and health needs, sign up for coverage. Again, you can do this at any time.

By following these steps, you can find and sign up for health insurance that keeps you covered and doesn’t break the bank.

What to Consider Before Buying Immediate Health Insurance?

Before you pick immediate health insurance, there’s a bunch of important stuff to think about to make sure you’re making a smart choice. This includes how much you’ll pay each month (premiums), how much you pay before your insurance starts covering costs (deductibles), what the insurance covers, which doctors you can see (provider networks), how long you might have to wait for some benefits to start (waiting periods), and what’s not covered at all (exclusions).

Understanding Premiums and Deductibles

It’s really important to get how premiums and deductibles work because they affect how much you pay for health care. Premiums are what you pay every month for your insurance. Deductibles are what you pay out of your pocket for healthcare before your insurance starts to pay. Sometimes, help like ACA subsidies or Medicaid, if you are financially eligible, can help make these costs easier to handle.

Looking at Coverage and Benefits

Make sure the insurance plan covers the health care services you need, like emergency room visits, medicine, and regular check-ups. ACA plans are required to cover a wide range of health services, which is great.

Checking the Network of Healthcare Providers

For ACA plans, see if your favorite doctors or hospitals are covered by the insurance plan. If you are over the age of 65 and eligible for Original Medicare due to a disability, the list of doctors and hospitals you can use is typically large and nationwide.

Understanding Waiting Periods and Exclusions

Some insurance plans won’t cover certain services right away (that’s the waiting period), and they might not cover everything you need (those are the exclusions). Plans like short-term medical insurance might only cover you for a little while and not cover everything. COBRA lets you keep your old job’s insurance for a bit after you leave, but it can be pricey. And Medicaid has rules about who can get it and what it covers.

By thinking about all these things, you can choose a health insurance plan that fits what you need and what you can afford.

Frequently Asked Questions

Can I buy health insurance immediately?

Yes, you can purchase certain types of health insurance coverage immediately, like short-term medical. There are also other options available for individuals who need immediate coverage, such as coverage for self-employed individuals, those between jobs, early retirees, or those in waiting periods.

What are the benefits of buying health insurance immediately?

Buying health insurance immediately can provide financial protection in case of unexpected medical expenses. It can also prevent any gaps in coverage which could result in costly out-of-pocket expenses.

What types of health insurance plans can I buy immediately?

You can buy a variety of health insurance plans immediately, including short-term health insurance, individual health insurance, or plans through the Affordable Care Act’s marketplace. It is important to research and compare the different options to find the best fit for your specific needs.

Do I need to be in perfect health to buy health insurance immediately?

No, you do not need to be in perfect health to buy health insurance immediately, especially during the ACA Annual Open Enrollment Period. However, some pre-existing conditions may affect the cost of your premiums or coverage options if you purchase insurance like short-term medical. It is important to disclose any pre-existing conditions when applying for insurance.

Can I cancel my health insurance if I buy it immediately?

Yes, you can cancel your health insurance if you buy it immediately. However, it is important to consider the potential consequences of canceling your coverage, such as being uninsured or being denied coverage for a pre-existing condition on a different health insurance plan in the future.

How can I buy health insurance immediately?

You can purchase health insurance immediately through various methods, including online through insurance companies or the Health Insurance Marketplace, over the phone, or in person with a licensed insurance agent. It is important to have all necessary information and documents ready when applying for coverage to ensure a smooth process.

877-246-0106

877-246-0106