The Biden administration has reopened the federal Health Insurance Marketplace, along with state exchanges, until May 15, 2021, to provide all Americans the opportunity to change their existing Affordable Care Act (ACA) health plan or buy health insurance if they are uninsured. Financial subsidies will be made available to those who qualify. This Special Enrollment Period is one attempt to help those who are uninsured due to the global COVID-19 pandemic or missed the regular Enrollment Period get coverage.

In these ever-changing times, the editorial staff connected with Pivot Health CEO, Jeff Smedsrud, and asked him questions about the state of the health insurance marketplace and what consumers should focus on in the coming months.

Q: If someone is shopping for health insurance right now, what should they do?

A: From February 15–May 15, 2021 consumers in all states have an opportunity to enroll in an Affordable Care Act (ACA) plan. This can be done through healthcare.gov or state-based marketplaces, and can also be done through private enrollment platforms and insurance brokers. There are many ways to enroll during this Special Enrollment Period (SEP) for ACA plans.

Q: During this SEP can I change the ACA plan I have to a different one, or this the SEP only for those who don’t have any health insurance?

A: Even if you already have a health insurance plan, you can switch to a new plan. If you don’t have a plan, you can buy one. It’s open shopping season.

Q: I hear there may be a new COVID-19 stimulus plan. How will it change health insurance?

A: First of all, there are no guarantees when predicting what politicians will do or when. That said, a new stimulus bill is largely expected to be approved in March.

Once President Biden signs the new coronavirus stimulus plan, the way premium subsidy calculations are made will change. More people will be eligible for subsidies. Experts estimate about 2 million people who otherwise would not have received a premium tax credit to lower their insurance cost will now be eligible. However, that does not mean ‘free’ insurance. The subsidies for some individuals will be small; for others, it will be larger. Subsidies tilt in favor of older Americans on average. Find out what your financial subsidy could be.

Q: I lost my job. I hear there may be subsidies for those who have continued coverage through COBRA?

A: Starting on the first of the month following the next coronavirus stimulus package, those who are eligible for COBRA — employees of companies with more than 20 full-time workers — could have up to 85% of the cost of COBRA reimbursed through September 30, 2021. However, if you worked for a small employer — 20 employees or less, there is NO subsidy of any kind, even if your state has a mini-COBRA law. (39 states and the District of Columbia do).

Q: Can I use PPP money to pay for health insurance?

A: Yes.

Q: If I am uninsured and newly pregnant, can I apply for Obamacare?

A: Under normal circumstances, no. You could only apply during the annual Open Enrollment Period. However, anyone can apply during the new SEP — for any reason.

Q: What if I don’t purchase coverage during this Special Enrollment Period?

A: If you don’t buy in the next 90 days, you would generally not be allowed to apply until November 1, 2021, unless you have a qualifying event such as job loss, moving to a new state, change in provider network and other reasons. If you don’t anticipate any major life changes, now is your opportunity to buy health coverage.

Q: What is the difference between the Open Enrollment Period and the Special Enrollment Period as relates to Biden’s enrollment extension of ACA plans?

A: To consumers, there is no difference. Some insurance companies pay agents less commission for individuals enrolled during SEP.

Q: If I buy an ACA plan, is my premium subsidy based on last year’s income, my current guess of income in 2021 or other factors?

A: It’s based on your best estimate of potential 2021 income at the time you apply. This is a very tricky, thorny issue. Your premium subsidy will eventually be reconciled to your actual income. For example, if you were a single individual and had taxable income of $60,000 in 2020, you would not have been eligible for a subsidy. But it’s February 2021 and you’re unemployed. You estimate your income will be $30,000 in 2021. Thus, you qualify for a subsidy on your insurance premium. But if the next week you get a new job — and it pays even more than the last gig — guess what? When you file your 2021 tax return you will have to give back some of that subsidy based on the months when your income exceeded the subsidy threshold.

In addition, if Congress passes another stimulus package, and you receive an unknown amount of stimulus income, it will be added to your total income for 2021. Confused? My best advice, be reasonable and honest about what you think you will actually earn in 2021 and use that best guess.

Q: What happens if the Supreme Court strikes down some of or all of the ACA in its upcoming ruling?

A: No one knows what the Supremes will do. But if they strike down some or all of the ACA, there will likely be a very rapid response from Congress now that Democrats control the House, the Senate, and the Presidency.

Q: What do you expect President Biden will do about the allowable duration for short-term medical plans? Will he use an Executive Order to limit plans to 90 days as President Obama did?

A: It’s too early to tell. We would certainly hope President Biden does not want to be the second President to say, “If you like the plan that you have, you can keep it” – and then cancel coverage if you have a certain type of insurance plan.

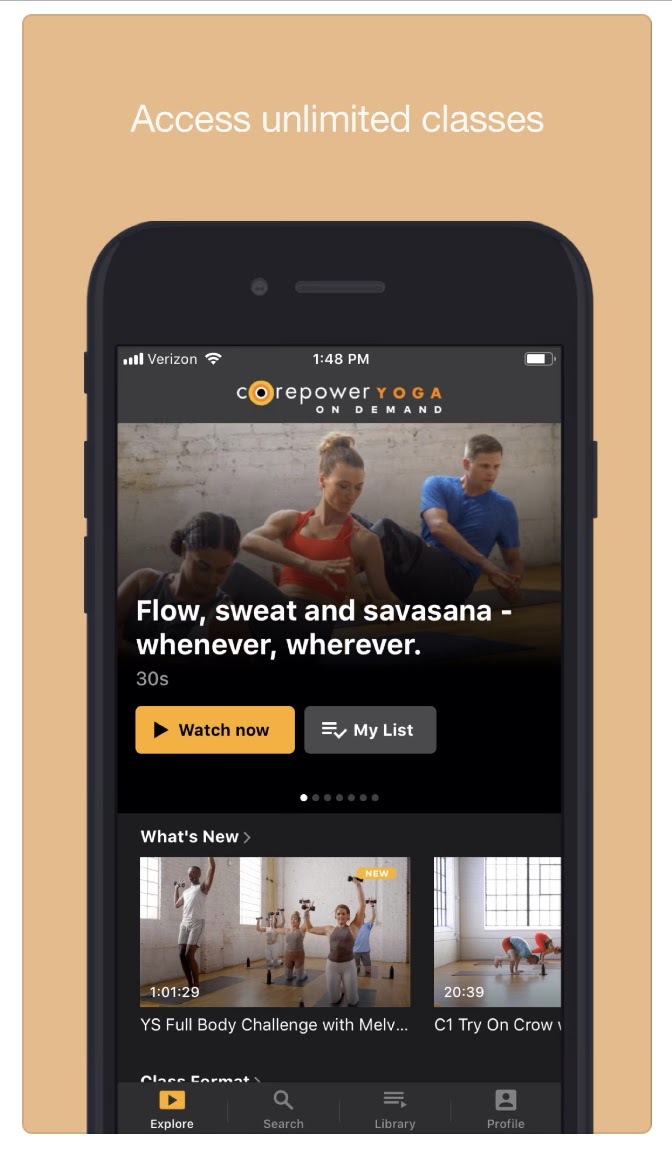

Q: Is short-term medical good for the healthcare economy?

A: Short-term medical (STM) insurance has always had a role for consumers who want choice and flexibility while dealing with a temporary need. This does not go away during this SEP, and will not go away after COVID-19. STM plans do act as a front door for many people who are uninsured. Nearly 9 out of 10 people who buy STM plans are uninsured. Many are in the gig economy.

A new report from Brian Blasé of the Galen Institute analyzes how short-term health insurance plans have impacted the insurance market since the Trump administration expanded options in 2018. “States that permit short-term plans have lost fewer enrollees in the individual market, have had far more insurers offer coverage in the market, and have had larger premium reductions since the 2018 rule took effect. The only states where individual market premiums have increased since 2018 are the five states that effectively prohibit short-term plans,” the report determined.

877-246-0106

877-246-0106